Alphabet, Google’s parent company, reported another pretty solid beat this afternoon for its first quarter as it more or less has continued to keep its business growing substantially — and is growing even faster than it was a year ago today.

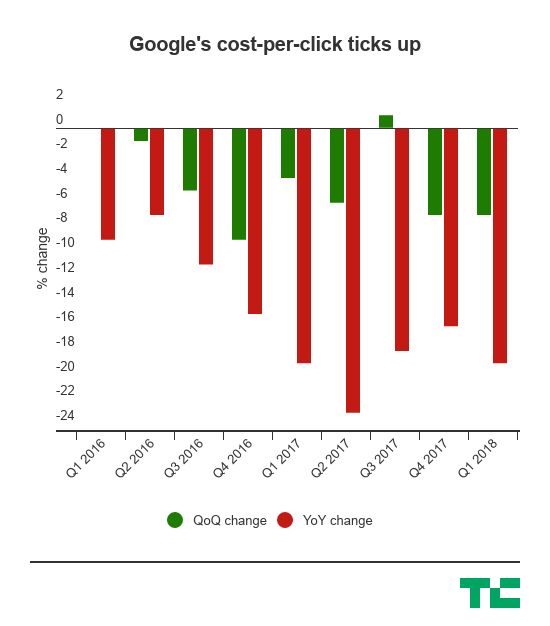

Google said its revenue grew 26% year-over-year to $31.16 billion in the first quarter this year. In the first quarter last year, Google said its revenue had grown 22% between Q1 of 2016 and Q1 of 2017. All this is a little convoluted, but the end result is that Google is actually growing faster than it was just a year ago despite the continued trend of a decline in its cost-per-click — a rough way of saying how valuable an ad is — as more and more web browsing shifts to mobile devices. Last year, Google said it recorded $24.75 billion in the first quarter.

Once again, Alphabet’s “other bets” — its fringe projects like autonomous vehicles and balloons — showed some additional health as that revenue grew while the losses shrank. That’s a good sign as it looks to explore options beyond search, but in the end it still represents a tiny fraction of Google’s overall business. This was also the first quarter that Google is reporting its results following a settlement with Uber, where it received a slice of the company as it ended a spat between its Waymo self-driving division and Uber.

Here’s the final scorecard:

- Revenue: $31.16 billion, compared to $30.36 billion Wall Street estimates and up 26% year-over-year.

- Earnings: $9.93 per share adjusted, compared to $9.28 per share from Wall Street

- Other Revenues: $4.35 billion, up from $3.27 billion in Q1 last year

- Other Bets: $150 million, up from $132 million in Q1 2017

- Other Bets losses: $571 million, down from $703 million in the first quarter last year

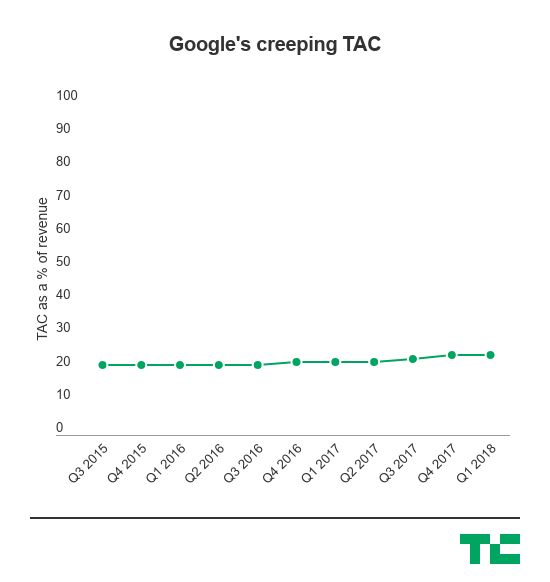

- TAC as a % of Revenue: 24%

- Effective tax rate: 11%, down from 20% in Q1 2017

In the end, it’s a beat compared to what Wall Street wanted, and it’s getting a very Google-y response. Investors were looking for earnings of $9.35 per share on $30.36 billion in revenue. Google’s stock is up around 2% in extended trading, which for Google is adding more than $10 billion in value as it races alongside Microsoft and Amazon to chase Apple as the most valuable company in the world by market cap. Google jumped as much as 5% in extended trading, though it’s flattened out

Google’s traffic acquisition cost, or TAC, appears to also remain stable as a percentage of its revenue. This is a little bit of a sticking point for observers for the company and a potential negative signal for investors as more and more web browsing shifts to mobile. It’s ticked up very slowly over the past several years, but is now sitting at around 24% of its total revenue.

Google, at its core, is an advertising company that is going to make money off its billions of users across all of its properties. But as everything goes to mobile devices, the actual value of those ads is going to drop off over time simply because mobile browsing has a different set of behaviors. Google’s business has always been to offset that cost-per-click with a growing number of impressions — and, indeed, it seems like the status quo is sticking around for this one.

While Google’s advertising business continues to chug along, that diversification of revenue streams is going to be increasingly important for the company as a hedge against any potential threats to its advertising income. Already there is some chaos when it comes to what’s happening with user data following a massive scandal where information on as many as 87 million Facebook users ended up with a political research firm, Cambridge Analytica. That backlash centered around user privacy may end up tapping Google, which dominates most of how information travels across the web with Gmail and Search among its other products.

But that still comes at a pretty significant cost. It’s made major investments into tools like Google Cloud (or GCP), but tucked into the earnings report is a line item that shows its “purchases of property and equipment” more than doubled year-over-year to around $7.3 billion, up from $2.5 billion in the first quarter this year. Of course this can encompass a ton of things, but Google still has to actually buy servers if it’s going to run a cloud platform that can compete with AWS or Microsoft’s Azure.

All that feeds into its “other income” stream, which grew from $3.2 billion in Q1 last year to $4.35 billion in the first quarter this year. Amazon’s cloud business is already more than a $10 billion business annually, and that first-mover advantage has served it well as it began a huge shift to how businesses operate on cloud servers. But it also exposed a massive business opportunity for Google, which continues to invest in that.

More From this publisher : HERE ; This post was curated using : TrendingTraffic

=>

***********************************************

Read More Here: Google beats expectations again with $31.15B in revenue

************************************

=>

Sponsored by our friends from Met001.biz

=>

This article was searched, compiled, delivered and presented using RSS Masher & TrendingTraffic

=>>

Google beats expectations again with $31.15B in revenue was originally posted by Viral News Feed 3

No comments:

Post a Comment